Online 1099 Misc

1099-MISC 1099 Tax Forms at Office Depot & OfficeMax. Shop today online, in stores or buy online and pick up in store.

1099 Misc form is used to report certain types of payments made in the course of a trade or business.

Online 1099 Misc Preparation

- 1099 forms are only filed on paper, so you cannot prepare and eFile a 1099 online. Follow these steps to prepare and file a Form 1099: Obtain a blank 1099 form (which is printed on special.

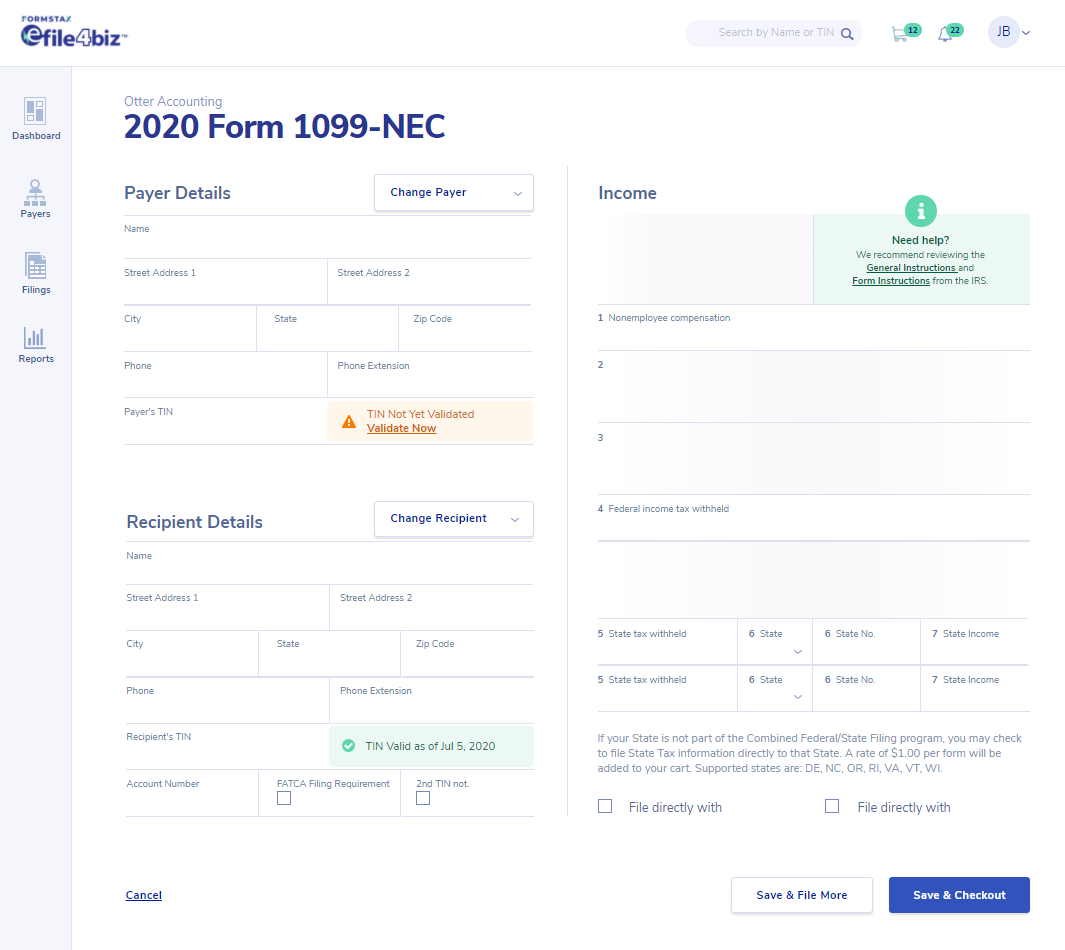

- ENTERING THE 1099 DATA It takes less than 10 minutes to enter your payer, payee and 1099 form information via our easy to use navigation process. You can also review your 1099 form.

- File 1099 Online with IRS approved eFile Service provider Tax1099. EFile 1099 MISC and more IRS forms 2020 eFiling is secure and easy by importing 1099 data with top integrations.

- At least $10 in royalties (see the instructions for box 2) or broker payments in lieu of dividends or tax-exempt interest (see the instructions for box 8)

- At least $600 in:

Online 1099-misc Form

- Rents (box 1);

- Prizes and awards (box 3);

- Other income payments (box 3);

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate (box 3);

- Any fishing boat proceeds (box 5);

- Medical and health care payments (box 6);

- Crop insurance proceeds (box 9);

- Payments to an attorney (box 10) (see Payments to attorneys, later);

- Section 409A deferrals (box 12); or

- Nonqualified deferred compensation (box 14).

1099 misc form has to be filed by businesses/individuals when payments are made in the course of your trade or business. Personal payments are not reportable. You are engaged in a trade or business if you operate for gain or profit. However, nonprofit organizations are considered to be engaged in a trade or business and are subject to these reporting requirements. Other organizations subject to these reporting requirements include trusts of a qualified pension or profit-sharing plans of employers, certain organizations exempt from tax under section 501(c) or (d), farmers' cooperatives that are exempt from tax under section 521, and widely held fixed investment trusts. Payments by federal, state, or local government agencies are also reportable.

- At least $10 in royalties

- At least $600 in rents, services (including parts and materials), prizes and awards, other income payments, medical and health care payments, crop insurance proceeds, cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

- Any fishing boat proceeds.

- Gross proceeds of $600 or more paid to an attorney.

- You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

Some payments are not required to be reported on Form 1099-MISC, although they may be taxable to the recipient. Payments for which a Form 1099-MISC is not required include:

- Generally, payments to a corporation

- Payments for merchandise, telegrams, telephone, freight, storage, and similar items

- Payments of rent to real estate agents

- Wages paid to employees (to be reported on form W-2)

- Military differential wage payments made to employees while they are on active duty in the Armed Forces or other uniformed services (report on Form W-2)

- Business travel allowances paid to employees (may be reportable on Form W-2);

- Cost of current life insurance protection (report on Form W-2 or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.);

- Payments to a tax-exempt organization including tax-exempt trusts (IRAs, HSAs, Archer MSAs, and Coverdell ESAs), the United States, a state, the District of Columbia, a U.S. possession, or a foreign government

It takes 3 simple steps to efile your 1099 misc form with 1099online.com

- Sign up on our website for free

- Fill in the payer, payee information. Fill in the 1099 misc form which is in the electronic format

- Submit the completed 1099 misc form to the IRS and that’s it.

You will receive your status confirmation within 24 hours depending on the IRS workload and you can even check your status on 1099online.com. For more information on your 1099 misc filing instructions visit:

http://www.irs.gov/instructions/i1099msc/ar02.html